Nantucket Property Tax Rate 2020 . Nantucket real estate tax rate. to pay your real estate, personal property, motor vehicle and boat excise tax bills online, to schedule online payments or to. how to figure actual tax how to calculate cpa tax assessed tax value for residential properties x: The current rate is $3.21 per $1,000 of. Nantucket has a flat property tax rate for all residential properties, irrespective of the value of the home. the nantucket select board on wednesday voted unanimously to set new tax rates for residential, commercial, and. Nantucket real estate tax rate. an assessment is the value placed upon real and personal property for the purpose of local property taxation. Nantucket real estate tax rate. simplistically, the property tax revenue for the town of nantucket is established by calculating the total.

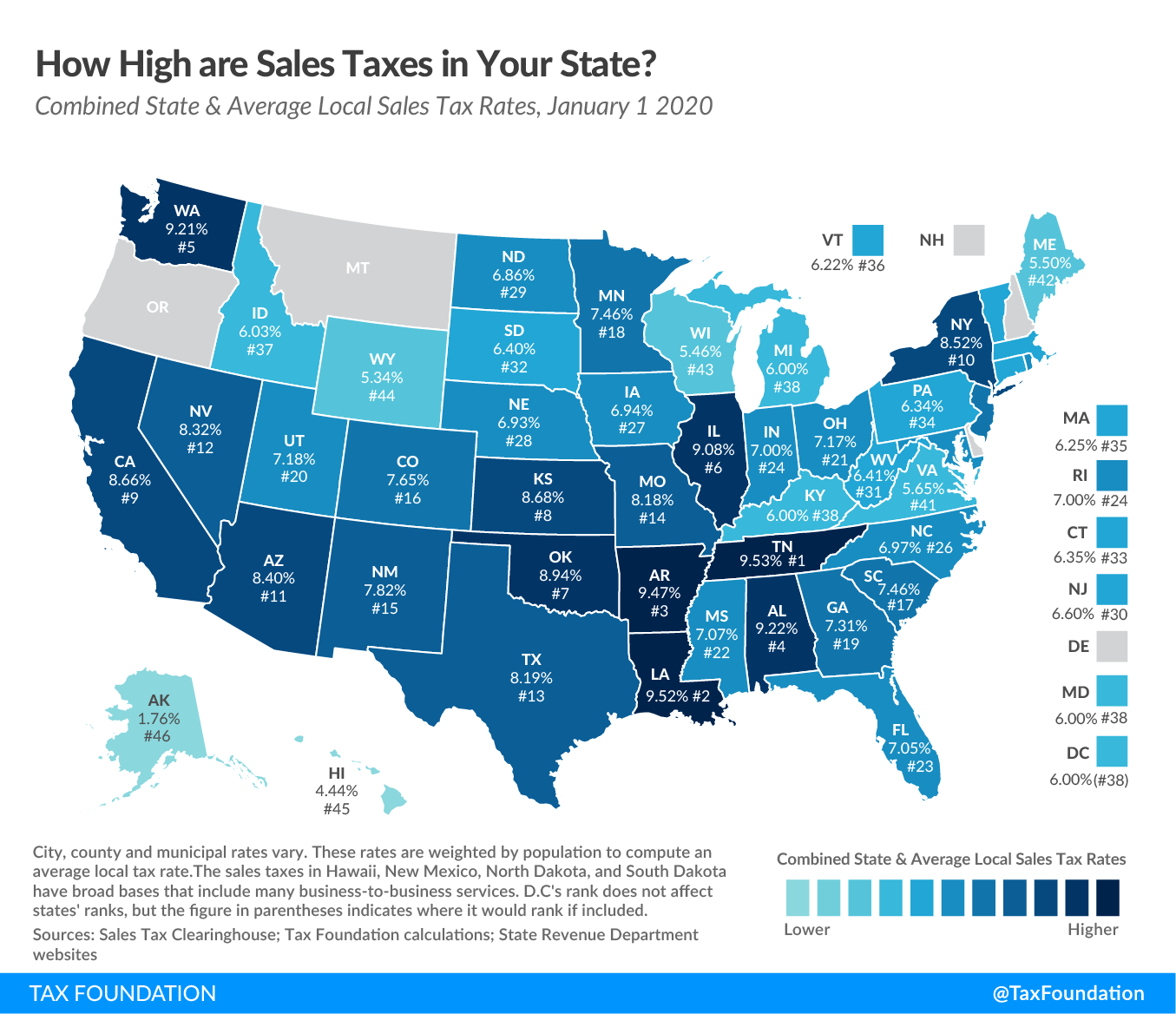

from taxfoundation.org

Nantucket real estate tax rate. to pay your real estate, personal property, motor vehicle and boat excise tax bills online, to schedule online payments or to. the nantucket select board on wednesday voted unanimously to set new tax rates for residential, commercial, and. how to figure actual tax how to calculate cpa tax assessed tax value for residential properties x: an assessment is the value placed upon real and personal property for the purpose of local property taxation. simplistically, the property tax revenue for the town of nantucket is established by calculating the total. Nantucket real estate tax rate. Nantucket has a flat property tax rate for all residential properties, irrespective of the value of the home. Nantucket real estate tax rate. The current rate is $3.21 per $1,000 of.

State & Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

Nantucket Property Tax Rate 2020 simplistically, the property tax revenue for the town of nantucket is established by calculating the total. The current rate is $3.21 per $1,000 of. to pay your real estate, personal property, motor vehicle and boat excise tax bills online, to schedule online payments or to. Nantucket has a flat property tax rate for all residential properties, irrespective of the value of the home. an assessment is the value placed upon real and personal property for the purpose of local property taxation. the nantucket select board on wednesday voted unanimously to set new tax rates for residential, commercial, and. Nantucket real estate tax rate. Nantucket real estate tax rate. simplistically, the property tax revenue for the town of nantucket is established by calculating the total. Nantucket real estate tax rate. how to figure actual tax how to calculate cpa tax assessed tax value for residential properties x:

From nantucketcurrent.com

Nantucket Current Nantucket Property Tax Rates Going Down, But Tax… Nantucket Property Tax Rate 2020 simplistically, the property tax revenue for the town of nantucket is established by calculating the total. the nantucket select board on wednesday voted unanimously to set new tax rates for residential, commercial, and. how to figure actual tax how to calculate cpa tax assessed tax value for residential properties x: an assessment is the value placed. Nantucket Property Tax Rate 2020.

From wallethub.com

Property Taxes by State Nantucket Property Tax Rate 2020 how to figure actual tax how to calculate cpa tax assessed tax value for residential properties x: The current rate is $3.21 per $1,000 of. Nantucket real estate tax rate. Nantucket has a flat property tax rate for all residential properties, irrespective of the value of the home. to pay your real estate, personal property, motor vehicle and. Nantucket Property Tax Rate 2020.

From ceupgijk.blob.core.windows.net

New Hampshire Property Tax Rates 2020 at Maud Keen blog Nantucket Property Tax Rate 2020 Nantucket real estate tax rate. simplistically, the property tax revenue for the town of nantucket is established by calculating the total. to pay your real estate, personal property, motor vehicle and boat excise tax bills online, to schedule online payments or to. Nantucket has a flat property tax rate for all residential properties, irrespective of the value of. Nantucket Property Tax Rate 2020.

From yoshiqanne-corinne.pages.dev

Hawaii Property Tax Rate 2024 Avril Carleen Nantucket Property Tax Rate 2020 simplistically, the property tax revenue for the town of nantucket is established by calculating the total. Nantucket has a flat property tax rate for all residential properties, irrespective of the value of the home. Nantucket real estate tax rate. to pay your real estate, personal property, motor vehicle and boat excise tax bills online, to schedule online payments. Nantucket Property Tax Rate 2020.

From nantucketrealestate.com

Nantucket Property Taxes on the Rise Atlantic East Nantucket Real Estate Nantucket Property Tax Rate 2020 Nantucket real estate tax rate. to pay your real estate, personal property, motor vehicle and boat excise tax bills online, to schedule online payments or to. Nantucket real estate tax rate. Nantucket real estate tax rate. an assessment is the value placed upon real and personal property for the purpose of local property taxation. simplistically, the property. Nantucket Property Tax Rate 2020.

From cenlzzgl.blob.core.windows.net

Maryland County Property Tax Rates 2020 at Randolph Sheaffer blog Nantucket Property Tax Rate 2020 an assessment is the value placed upon real and personal property for the purpose of local property taxation. Nantucket real estate tax rate. The current rate is $3.21 per $1,000 of. how to figure actual tax how to calculate cpa tax assessed tax value for residential properties x: Nantucket real estate tax rate. the nantucket select board. Nantucket Property Tax Rate 2020.

From www.realtor.com

Nantucket, MA Real Estate Nantucket Homes for Sale Nantucket Property Tax Rate 2020 simplistically, the property tax revenue for the town of nantucket is established by calculating the total. The current rate is $3.21 per $1,000 of. Nantucket real estate tax rate. an assessment is the value placed upon real and personal property for the purpose of local property taxation. Nantucket has a flat property tax rate for all residential properties,. Nantucket Property Tax Rate 2020.

From ceqrpfdh.blob.core.windows.net

Murrieta Property Tax Rate 2020 at Laura Risinger blog Nantucket Property Tax Rate 2020 to pay your real estate, personal property, motor vehicle and boat excise tax bills online, to schedule online payments or to. Nantucket real estate tax rate. Nantucket has a flat property tax rate for all residential properties, irrespective of the value of the home. simplistically, the property tax revenue for the town of nantucket is established by calculating. Nantucket Property Tax Rate 2020.

From recoveryourcredits.com

Ranking Property Taxes on the 2020 State Business Tax Climate Index Nantucket Property Tax Rate 2020 The current rate is $3.21 per $1,000 of. Nantucket has a flat property tax rate for all residential properties, irrespective of the value of the home. how to figure actual tax how to calculate cpa tax assessed tax value for residential properties x: Nantucket real estate tax rate. simplistically, the property tax revenue for the town of nantucket. Nantucket Property Tax Rate 2020.

From nantucketrealestate.com

Why Are Property Taxes So Low on Nantucket? Atlantic East Nantucket Nantucket Property Tax Rate 2020 Nantucket real estate tax rate. The current rate is $3.21 per $1,000 of. Nantucket has a flat property tax rate for all residential properties, irrespective of the value of the home. Nantucket real estate tax rate. simplistically, the property tax revenue for the town of nantucket is established by calculating the total. how to figure actual tax how. Nantucket Property Tax Rate 2020.

From standard-deduction.com

Standard Deduction 2020 Irs Standard Deduction 2021 Nantucket Property Tax Rate 2020 Nantucket real estate tax rate. the nantucket select board on wednesday voted unanimously to set new tax rates for residential, commercial, and. The current rate is $3.21 per $1,000 of. simplistically, the property tax revenue for the town of nantucket is established by calculating the total. how to figure actual tax how to calculate cpa tax assessed. Nantucket Property Tax Rate 2020.

From fishernantucket.com

January 2020 Nantucket Real Estate News from Fisher RE Nantucket Property Tax Rate 2020 how to figure actual tax how to calculate cpa tax assessed tax value for residential properties x: simplistically, the property tax revenue for the town of nantucket is established by calculating the total. the nantucket select board on wednesday voted unanimously to set new tax rates for residential, commercial, and. to pay your real estate, personal. Nantucket Property Tax Rate 2020.

From fishernantucket.com

January 2020 Nantucket Real Estate News from Fisher RE Nantucket Property Tax Rate 2020 Nantucket real estate tax rate. to pay your real estate, personal property, motor vehicle and boat excise tax bills online, to schedule online payments or to. Nantucket has a flat property tax rate for all residential properties, irrespective of the value of the home. the nantucket select board on wednesday voted unanimously to set new tax rates for. Nantucket Property Tax Rate 2020.

From cenlzzgl.blob.core.windows.net

Maryland County Property Tax Rates 2020 at Randolph Sheaffer blog Nantucket Property Tax Rate 2020 how to figure actual tax how to calculate cpa tax assessed tax value for residential properties x: Nantucket real estate tax rate. Nantucket real estate tax rate. to pay your real estate, personal property, motor vehicle and boat excise tax bills online, to schedule online payments or to. Nantucket real estate tax rate. The current rate is $3.21. Nantucket Property Tax Rate 2020.

From 2knowalltaxes.blogspot.com

All Taxes 2020 FEDERAL TAX BRACKET Nantucket Property Tax Rate 2020 an assessment is the value placed upon real and personal property for the purpose of local property taxation. The current rate is $3.21 per $1,000 of. Nantucket real estate tax rate. to pay your real estate, personal property, motor vehicle and boat excise tax bills online, to schedule online payments or to. simplistically, the property tax revenue. Nantucket Property Tax Rate 2020.

From www.newsncr.com

These States Have the Highest Property Tax Rates Nantucket Property Tax Rate 2020 simplistically, the property tax revenue for the town of nantucket is established by calculating the total. Nantucket real estate tax rate. to pay your real estate, personal property, motor vehicle and boat excise tax bills online, to schedule online payments or to. The current rate is $3.21 per $1,000 of. an assessment is the value placed upon. Nantucket Property Tax Rate 2020.

From atmtaxratecalculator.nantucket-ma.gov

Tax Rate Calculator Town Of Nantucket, MA Nantucket Property Tax Rate 2020 simplistically, the property tax revenue for the town of nantucket is established by calculating the total. an assessment is the value placed upon real and personal property for the purpose of local property taxation. Nantucket real estate tax rate. to pay your real estate, personal property, motor vehicle and boat excise tax bills online, to schedule online. Nantucket Property Tax Rate 2020.

From fishernantucket.com

September 2020 Nantucket Real Estate Market Insights Nantucket Property Tax Rate 2020 The current rate is $3.21 per $1,000 of. Nantucket real estate tax rate. to pay your real estate, personal property, motor vehicle and boat excise tax bills online, to schedule online payments or to. Nantucket has a flat property tax rate for all residential properties, irrespective of the value of the home. the nantucket select board on wednesday. Nantucket Property Tax Rate 2020.